4 Important Things To know Before Applying For A Bridging Loan

Individuals with bad credit have more challenges in obtaining standard bank loans. They struggle more to get funds to purchase property and refurbish homes and mortgages. If you are one of them, the good news is that you can also receive bridging finance. However, you may have to pay a high-interest rate. You can also get loans from reputable p2p lending platforms running online. In this article, we are going to describe 4 tips for those who want to secure bridging debt from a p2p platform.

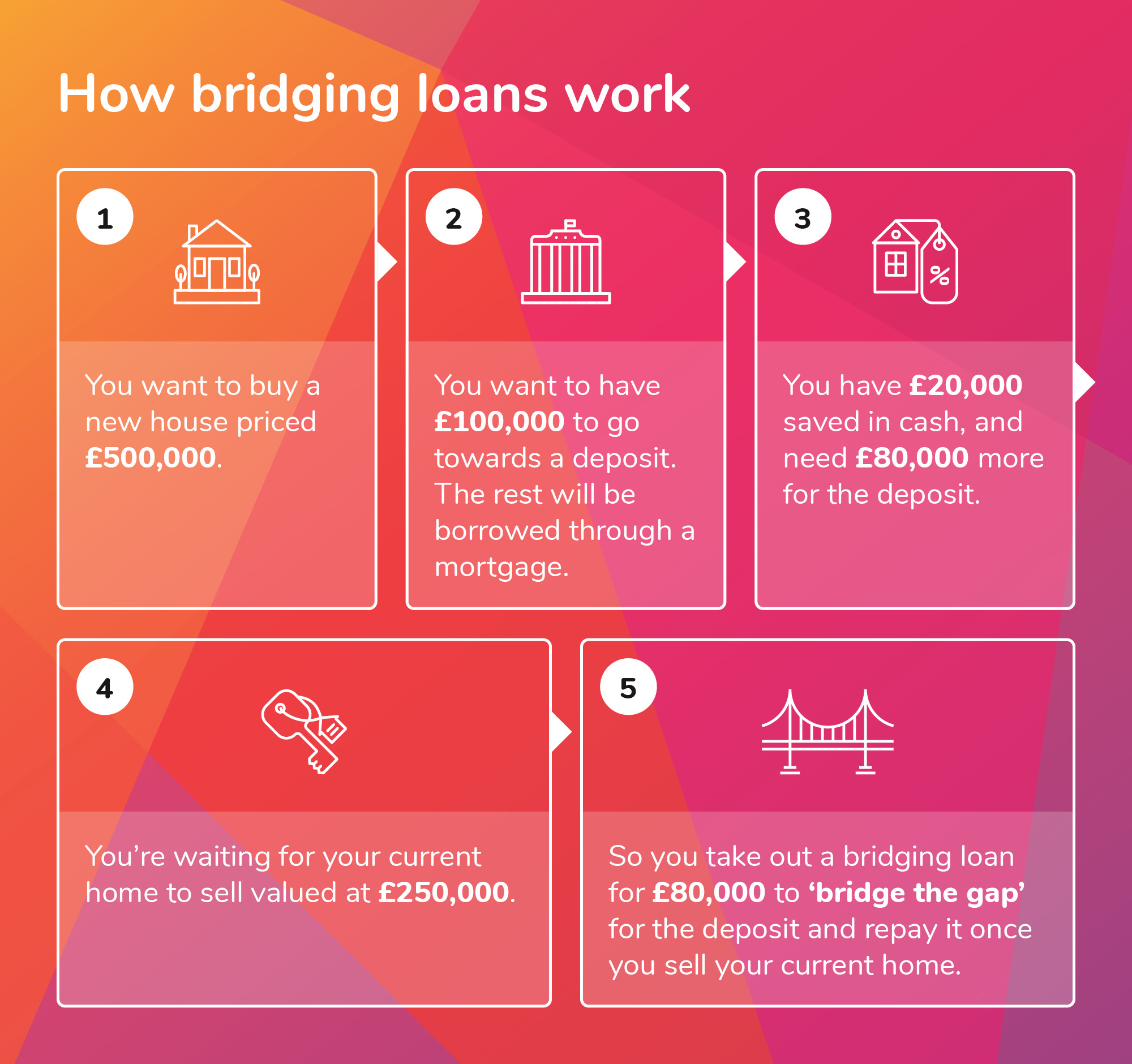

1. Bridging Finance Is A Short-Term Solution

Bridging loans are a short-term funding source for those who need funds to fulfil their emergency financial needs. These loans provide you stability during the property purchase period. You can use it to complete the [purchase of a property before the sale of an existing one. Or even in emergencies like when you need to prevent your home from repossession. These funds help you stop the transfer of your home to someone else's name.

The peer-to-peer lending platforms offer bridging loans that can be tailored according to the needs of borrowers.

With the help of this loan, you can also start a property development project and start making money. You get access to funds in a short time and start using the money as soon as the lender transfers it to your bank account. Afterwards, you can repay the loan amount according to the lending terms and conditions so that you can gain full benefits from it.

2. Effective way To Gather Funds

The p2p lending platform offers loan terms matching your needs.

You can secure bridging finance within a short period. However, you should keep in mind that these loans are typically more expensive than standard bank loans, with interest rates as minimum as 2% per month. Other charges like arrangement fees, valuation fees and legal fees also add up to the cost and make it an expensive way of borrowing.

3. How To Take Out A Bridging Loan?

The peer-to-peer lending platforms specialise in providing affordable bridging loans. Their teams of experts can describe the loan terms in detail. Thus, they can give useful tips on the lending process along with other helpful information. Ultimately, it helps you in completing the loan application. Also, these platforms access the creditworthiness of the borrowers and let them know if that bridging debt is suitable for them.

You do not need to worry even if you have prior unpaid mortgage payments in your credit history because you still have a chance to qualify for a non-status category bridging loan. But in most cases, you have to use your property as collateral.

If an applicant meets all the basic requirements, they can easily obtain a loan regardless of their current income or credit history.

Read More : The Pros and Cons of Bridging Loans

4. Bridging Loans Provides Several Benefits

When you choose bridging finance over the mortgage or traditional property loans, you can get the following benefits:

1. Quick Arrangement:

Applying for a mortgage or remortgage can take longer than bridging debt. Moreover, after getting approval, you can transfer funds to your bank account within two to three days. It helps you in meeting your financial needs and get more time to secure long-term funding.

2. Flexible Repayments:

3. Other Reasons:

Thus by choosing bridging finance, one thing is guaranteed you will get the money you need even if your credit score is below average.

Conclusion

Bridging loans provide individuals and companies quick access to cash, while mortgage and bank loans take a long time. If you struggle to take out a loan due to bad credit history or are a new business, it is worth considering bridging finance. You can find many p2p platforms offering these loans, but you should always choose a reputable platform that the Financial Conduct Authority authorises. It can help you in getting the money you need without damaging your credit score. We hope this article will help you get the right funds to overcome your financial problems.

Thank you for sharing these crucial factors to consider before applying for a commercial bridging loans, your information is incredibly helpful for anyone who is navigating the process of securing a bridging loan. again thanks lot! Keep up the great work in providing such informative content.

ReplyDelete